Get Your Copy of the FIRST Comprehensive Book Ever Written on 721 Exchange UPREITs

Dwight Kay,

Founder and CEO of Kay Properties & Investments

Author of the First-Ever Book on 721 Exchange UPREITs

As the author of the definitive guide on 721 Exchange UPREITs, Dwight blends detailed observations drawn from real world experience with practical investment strategies into an easy-to-read chronicle of the entire 721 Exchange UPREIT process from start to finish.

Through compelling real life case studies, Kay showcases how investors can successfully transition out of a Delaware Statutory Trust into a potentially more liquid and diversified portfolio.

It is a must read for today’s 1031 Exchange investors, financial advisors, and CPA’s.

What’s Inside 721 Exchange UPREITS - What Investors Need to Know Before Investing?

- WHAT IS A 721 Exchange UPREIT

- A framework for rigorous 721 Exchange UPREIT Due Diligence.

- The risks when dividends are paid from borrowings in Perpetual Non-Listed REITs.

- The long-term sustainability of dividends covered by Adjusted Funds From Operations (AFFO).

- Understanding the Crucial Role of Tax Protection Agreements

- How to Access DST 721 Exchange UPREIT Opportunities

As a recognized expert, Dwight Kay has been featured in prominent business publications for his insights on 721 Exchange UPREITs

Three Key Items to Evaluate When Choosing a 721 Exchange

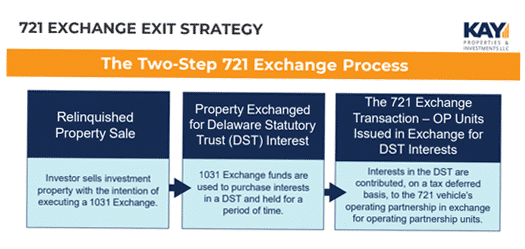

Due to the increased popularity among investors to participate in a 1031 exchange into a Delaware statutory trust (DST) that has a 721 exchange exit strategy, there has been a greater number of new entrants into the space. This increased level of options makes it even more difficult for investors to decide which of the DST and resulting 721 exchange UPREIT offerings is the most appropriate for their particular situation.

At Kay Properties, we have been helping 1031 exchange investors evaluate DST, UPREIT (umbrella partnership real estate investment trust) and 721 exchange offerings for nearly two decades and have helped thousands of investors nationwide through this process into over 9,000 separate DST and 721 exchange investments.

Here are some of our top items for investors to consider about the REIT (real estate investment trust) they’ll ultimately be invested in when evaluating a DST with a 721 exchange exit strategy:

Dwight Kay, Founder and CEO of Kay Properties & Investments, Educates Rental Property Owners and Real Estate Investors on the 721 Exchange UPREIT Strategy Utilized by Delaware Statutory Trust and 1031 Exchange Investors

Kay, a leading figure in the DST 1031 Exchange field, was recently selected to present to a group of rental property owners and real estate investors on how investors can utilize the lesser known 721 Exchange UPREIT strategy and the Delaware Statutory Trust for their long-term real estate investment goals.

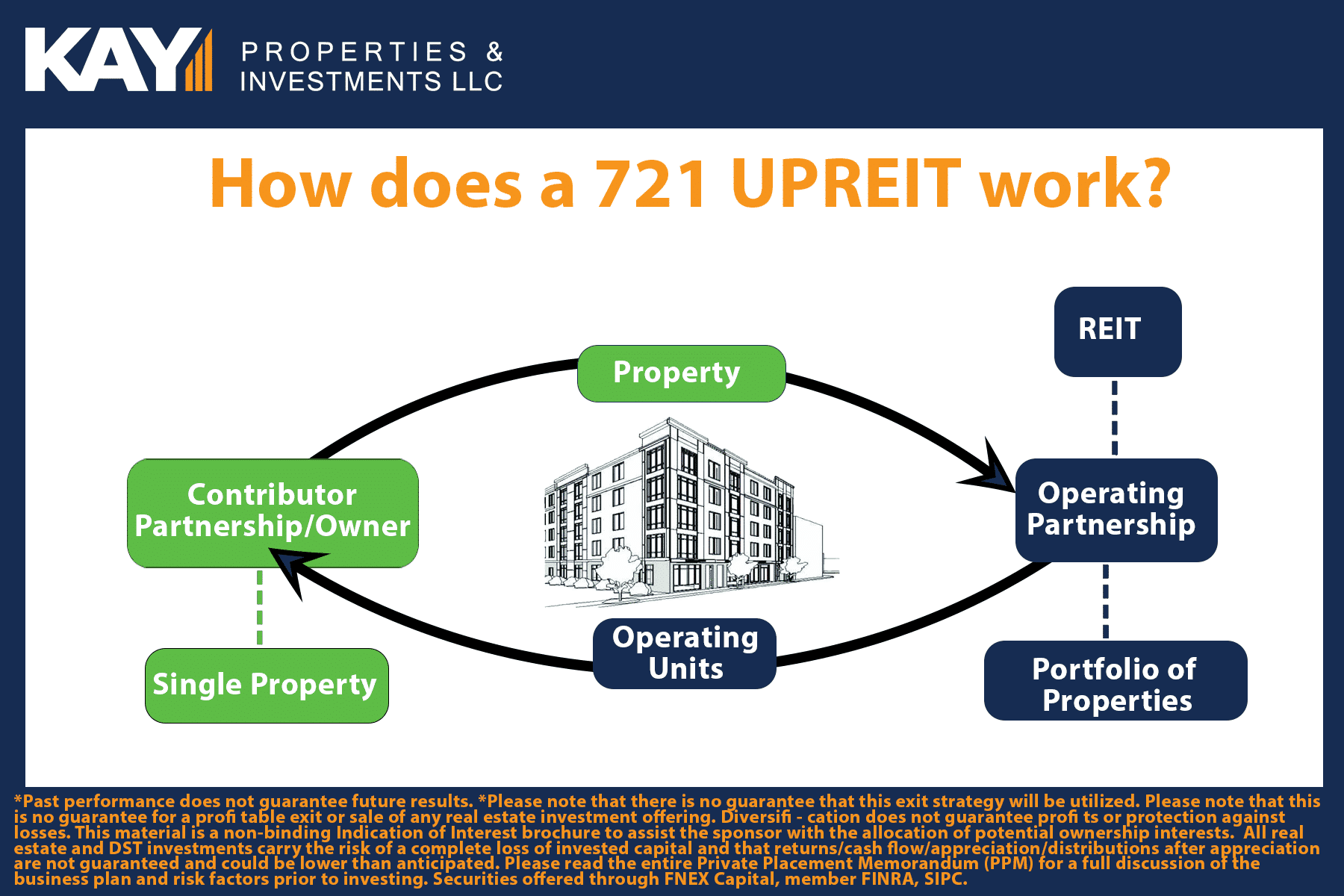

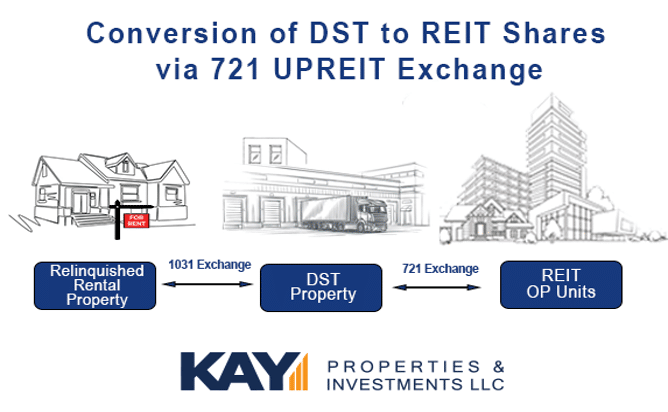

How 721 Exchanges Can Be Used as an Exit Strategy for Delaware Statutory Trust 1031 Exchanges

One of the most important questions that real estate investors sometimes forget to ask themselves is, “What is my long-term, exit strategy?” This is especially the case for investors who are considering a Delaware Statutory Trust (DST) investment as part of their 1031 Exchange strategy.Comprehensive 721 Exchange Resource Library

721 Exchange UPREIT Insight Series The 721 Exchange Option – Not the Obligation

In today’s complex real estate market, understanding the nuances of 721 UPREIT DST structures is essential for any investor. One of the critical features of these arrangements is that the REIT holds the option—but not the obligation—to purchase the DST’s property through the UPREIT strategy. This subtle distinction can have profound implications for investors, making due diligence not just advisable, but critical.

Due Diligence 101 on 721 Exchange UPREIT DST Investments

In recent years, non-traded and perpetual life REITs have emerged as attractive vehicles for real estate investors, especially within the 721 UPREIT DST structure. While these vehicles offer tax-deferred exchange benefits and diversified exposure to real estate, investors must scrutinize several key financial metrics to avoid hidden pitfalls.

721 Exchange UPREITs and Delaware Statutory Trust Offerings – Essential Items to Consider before Investing

Over the years, the use of the 721 Exchange as a Delaware Statutory Trust exit strategy has become increasingly popular among investors for a number of reasons, including the ability to provide tax deferral benefits, the potential for portfolio diversification, the potential for portfolio income and appreciation, and enhanced liquidity.

However, real estate professionals will often cite the words, "Caveat Emptor," a Latin phrase meaning "Buyer Beware." This concept, originating from Roman law, emphasizes the buyer's responsibility to thoroughly assess the quality and suitability of a purchase.

This article is designed to provide valuable information for investors in order to adopt the "Caveat Emptor" mindset when considering 721 Exchange UPREITs as part of a 1031 exchange strategy.

1031 Exchanging Into a REIT: The 721 UPREIT as an Option for Investors

Here at Kay Properties, we have many clients who inquire about different 1031 exchange options. Some of our investors have inquired about the 721 UPREIT (Umbrella Partnership Real Estate Investment Trust) mechanism in both DSTs and Private and Publicly Registered Non-Traded REITS. The question that many investors ask is – Can I 1031 Exchange into a REIT? The 721 UPREIT can be a potential answer to this question, however there are multiple items that investors must be aware of and carefully consider prior to deciding to pursue this route.